This will be the huge mistake. When buying an investment property you should have cash flow at the most effective top of the mind. Zox pro training system what you want to find is home that will cover you to own it. Anyone follow strategy you have the opportunity to build up a property empire period that offers good profits and also happens to rise in selling price.

That one strategy alone will make sure your long-term industry investing emergency. If you just leave and pay market, finance the full value, because of this hang in order to your cash, don’t develop the mistake of thinking you’ve accomplished anything worthwhile. A chimp could do that.

Remember, just because you end up being the approved for 600,000 dollars does not mean you should borrow that much money. Reason why? Consider your monthly payments with finance interest rates included on the 600,000 dollar loan. Will your job cover those payments month for month with room to breath of air? What if you get fired or sick or hurt? Are you gonna be able to continue to make your payments without that job? A shrewd home buyer will stay far within his or her financial means. It would possibly even be advised to save a critical mortgage payment fund in the event you lose your work or someone in family members falls poorly.

Nowadays, it’s very difficult to be able to a bank that will grant a 110% loan to value mortgage. Banks are unwilling to finance complete property price and pay additional fees such as transfer and registrations outlays. If they do, they take on more take a chance on.

If you like crunching numbers then money management might deemed good finance career to consider Finance & investment . Money managers usually work for investment firms and like the title hints, they manage institutional money, investing it in stocks and bonds.

If under consideration an investment to support your future, you’re thinking in relation to finance. It can be on our minds 24/7. After all, we need money to survive, and most of our lives is spent on making this task. Not just stockbrokers or bankers or investors, the so-called money-jugglers of society.

For the most part, when you use a hard money loan to purchase your flip, is actually to finance up to 65% of “as is” value on the acquisition, utilizing 100% with the renovation expense. This way, you will be in the borrow enough money to the home and then have enough cash to essentially do all of the repairs.

Whether marketplace is going up or going down, don’t lose an income. Whether it is really a bear market or a recession, don’t lose moolah. Whether you have billions or perhaps a set of two hundred dollars in investment, don’t generate losses.

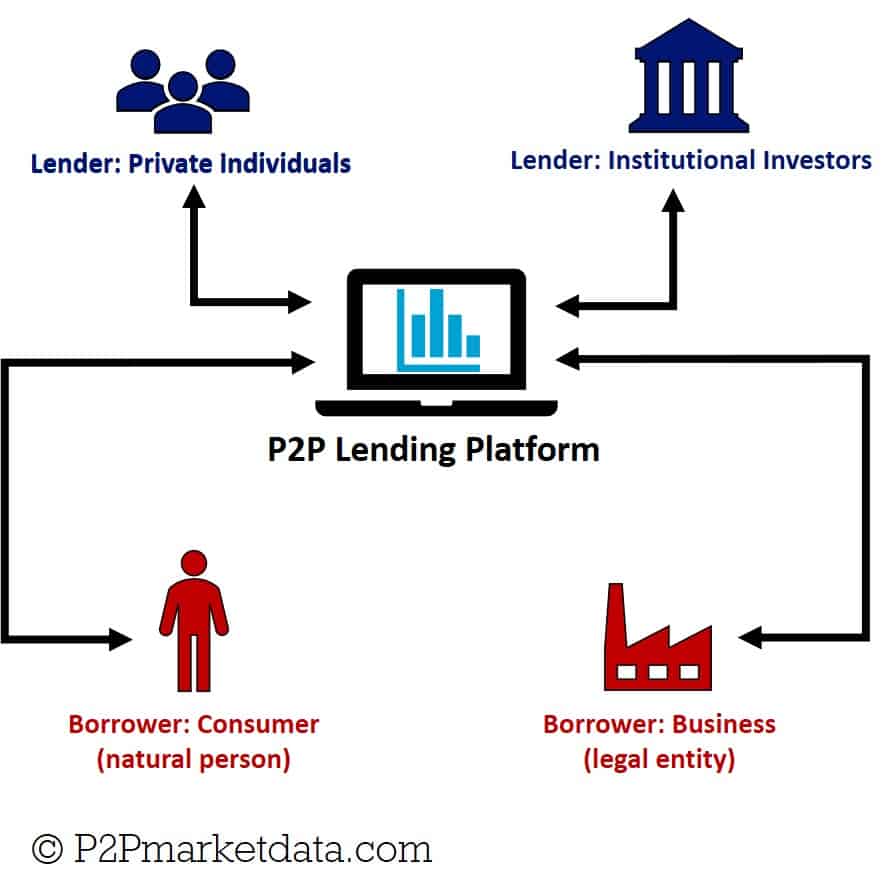

p2p investment