Protecting Your Castle: Unveiling the Secrets of Homeowners Insurance

Welcome to the world of homeowners insurance, where protecting your castle is of utmost importance. As a homeowner, it’s essential to safeguard your most significant investment and ensure peace of mind in the face of unexpected events. Just like how we rely on car insurance or auto insurance for our vehicles, homeowners insurance offers a layer of much-needed protection for our homes. In this article, we will unveil the secrets behind homeowners insurance, shedding light on why it is crucial for every homeowner to have this type of coverage. So, let’s delve into the world of homeowners insurance and discover the peace and security it offers.

Understanding Homeowners Insurance

Homeowners insurance is a crucial component of protecting your home and belongings. It offers financial coverage in the event of damage or loss, providing peace of mind for homeowners. While often associated with home insurance, it’s important to note that homeowners insurance can also extend coverage to other aspects, such as car insurance or auto insurance.

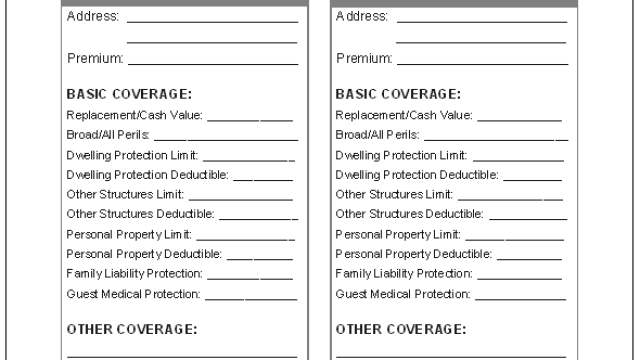

One of the key aspects of homeowners insurance is property coverage. This protects the structure of your home, including the walls, roof, and foundation, from damage caused by covered perils like fire, theft, or severe weather conditions. It is essential to understand the terms and limitations of your policy to ensure you have adequate protection for your property.

In addition to property coverage, homeowners insurance also provides personal liability coverage. This means that if someone suffers an injury on your property and holds you responsible, your insurance can help cover their medical expenses or legal fees. It offers you protection from potential lawsuits and can save you from significant financial burdens.

Understanding the different types of coverage available is vital when purchasing homeowners insurance. It’s essential to consider your unique needs and select a policy with appropriate limits and deductibles. By doing so, you can ensure your home and belongings are safeguarded in times of unforeseen accidents or unfortunate circumstances.

The Importance of Car Insurance

A reliable car insurance policy is essential for all vehicle owners. It serves as a protective shield that safeguards against unforeseen accidents, thefts, and damages. Car insurance provides the necessary financial support, allowing you to get back on the road quickly without worrying about the high costs that can accompany unfortunate incidents.

Having car insurance also ensures that you are acting responsibly as a driver. It not only protects you but also extends its coverage to others on the road, providing compensation for injuries or damages caused by your vehicle. With the increasing number of accidents and uncertainties on the road, it has become imperative to have sufficient car insurance coverage to shield yourself from potential legal and financial consequences.

Furthermore, the benefits of car insurance go beyond just accidents. It can also help you safeguard against theft, vandalism, or natural disasters that may cause damage to your vehicle. Repairing or replacing a stolen or damaged car can be a significant financial burden, but with the right insurance coverage, you can have peace of mind knowing that your insurance company will help you bear the cost.

In summary, car insurance is far from being an optional expense; it is an absolute necessity for any vehicle owner. It offers protection, financial support, and ensures that you are meeting your legal obligations as a responsible driver. By investing in comprehensive car insurance, you can navigate the roads with confidence, knowing that you are shielded from potential risks that may come your way.

Key Factors to Consider for Auto Insurance

When it comes to auto insurance, there are certain key factors that you should take into consideration to ensure that you have the coverage you need. These factors can help you make an informed decision when choosing an auto insurance policy.

Coverage Options: One of the most important factors to consider is the coverage options available to you. Auto insurance policies typically offer different levels of coverage, such as liability coverage, collision coverage, and comprehensive coverage. Understanding what each type of coverage entails and assessing your specific needs can help you determine the right level of protection for your vehicle.

Deductibles: Another factor to consider is the deductible amount. The deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Opting for a higher deductible may lower your premium but could also mean bearing a larger financial burden in the event of a claim. Assess your budget and risk tolerance to choose a deductible that suits your circumstances.

Cost and Discounts: Cost is often a crucial factor for many individuals when choosing auto insurance. Comparing quotes from different insurance providers can help you find a policy that fits within your budget. Additionally, many insurers offer various discounts that can help reduce your premium. Some common discounts include safe driver discounts, multi-policy discounts, and discounts for having certain safety features in your vehicle.

Best Homeowners Insurance Michigan

By considering these key factors – coverage options, deductibles, and costs – you can navigate the world of auto insurance with confidence, knowing that you have the right level of protection for your vehicle at a price that suits your needs and budget. Remember to review and reassess your auto insurance policy periodically to ensure it continues to meet your changing circumstances.